Spot Fake Numbers: The rising cases of cyber fraud in India have prompted the government to take action. In response, the Department of Telecommunications (DoT) has launched a special tool called the Financial Fraud Risk Identifier (FRI). This tool will help users verify if a phone number is genuine or fake before making any online payment, thereby aiming to protect them from potential scams.

Spot Fake Numbers: Growing Cyber Frauds Push Indian Government to Launch Innovative Security Tool

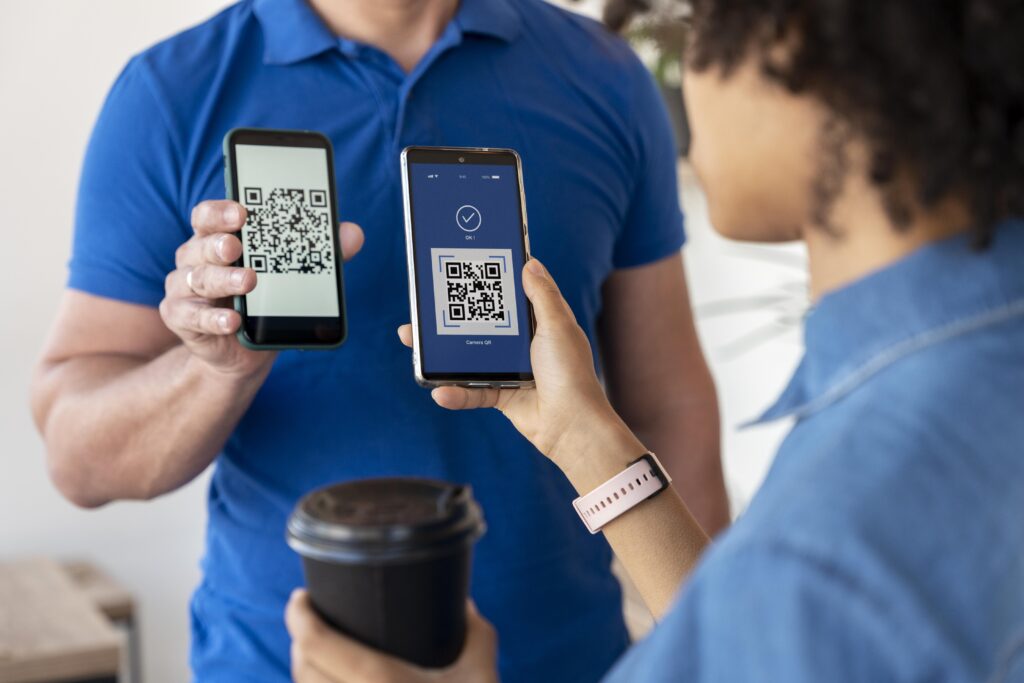

Digital Payment: India has been witnessing a sharp rise in online scams and financial frauds in recent years. These incidents not only target individuals but also put the overall trust in digital payments at risk. Concerned about this growing threat, the Department of Telecommunications (DoT) has taken an important step to ensure online safety. It has rolled out an innovative tool called the Financial Fraud Risk Identifier (FRI), which aims to detect and warn about suspicious mobile numbers before any money is transferred.

The FRI tool is a crucial component of the government’s Digital Intelligence Platform. Its main goal is to identify mobile numbers that have been linked to online fraud activities. As the number of online transactions grows, so does the need for reliable safeguards. This tool provides a way to verify the authenticity of a mobile number before sending money to it.

The FRI tool categorizes mobile numbers into three distinct levels of risk: Medium Risk, High Risk, and Very High Risk. A number marked as Very High Risk suggests that the likelihood of fraud is at its peak if any financial transaction is made with it. This classification helps people to make informed decisions and avoid becoming victims of fraudsters.

The system behind the FRI tool uses comprehensive data gathered from several reliable sources. It includes information from government-run portals such as the Chakshu platform, where individuals can report suspicious activity. It also draws data from the National Cybercrime Reporting Portal (NCRP), which allows citizens to file complaints about cybercrime incidents. Additionally, banks contribute to this initiative by sharing details of fraud cases reported by their customers. All this data is integrated into the FRI database to create a dynamic and constantly updated risk-assessment system.

Whenever someone reports a fraudulent mobile number, the FRI tool takes note of it. This information is instantly added to its database, ensuring that the tool remains up to date and can alert users in real time. This quick response is vital in the fight against fast-moving cybercriminals.

Several major digital payment apps are already seeing the benefits of this new tool. PhonePe has been among the first to integrate the FRI tool into its payment system. The app will automatically stop payments to numbers labeled as High Risk. For numbers considered Medium Risk, users will receive an alert before proceeding, encouraging them to think twice and verify the identity of the recipient.

Other popular digital payment services, such as Google Pay and Paytm, have recognized the importance of this tool and are actively working on including it in their platforms. These apps play a significant role in India’s digital economy, and integrating the FRI tool will enhance their ability to protect users against fraud.

Non-Banking Financial Companies (NBFCs) are also on board with this initiative. These organizations provide various financial services and cater to a large customer base. By using the FRI tool, they can offer extra protection to their customers, helping to reduce financial fraud across the board.

The Department of Telecommunications has ambitious plans for the FRI tool. It wants it to be a standard feature across all digital transactions in India. By promoting its widespread use, the government hopes to make the digital payment environment safer and more reliable for everyone.

A key strength of the FRI tool is its real-time functionality. Unlike traditional methods of fraud prevention, which often rely on static databases or delayed updates, this tool reacts instantly when new information becomes available. As soon as a fraudulent number is identified, the tool updates its records and shares the data with banks and UPI services. This real-time approach significantly improves the chances of preventing fraud before it happens.

The launch of this tool highlights the government’s commitment to fighting cybercrime and building trust in digital payments. India has been making significant strides in digital transformation, and tools like FRI are essential in maintaining momentum while ensuring that users remain safe.

Ultimately, this initiative is about giving people the confidence to embrace digital transactions without fear. When users know that a reliable system is monitoring for fraud and can warn them in advance, they’re more likely to feel secure about using online payment services. By providing timely alerts and categorizing the risk level of mobile numbers, the FRI tool empowers individuals to make better decisions and avoid risky transactions.

With cybercrime evolving rapidly, the government’s proactive steps are crucial in staying one step ahead of fraudsters. The Financial Fraud Risk Identifier is more than just a tool—it’s a powerful ally in the ongoing effort to keep digital transactions safe, transparent, and trustworthy for everyone in India.

Also Read:

- New Voice Chat Feature for WhatsApp Groups

- Biggest Discount Ever on iPhone 16 Pro! Price at Rs 83,250

Author

Aniket Kumar

Aniket Kumar is a tech enthusiast and gadget reviewer at InsightIndia.in. With a keen eye for innovation and usability, he simplifies the latest in smartphones, wearables, and consumer tech for everyday readers. When he’s not testing new devices, Aniket is exploring how technology is shaping the future.